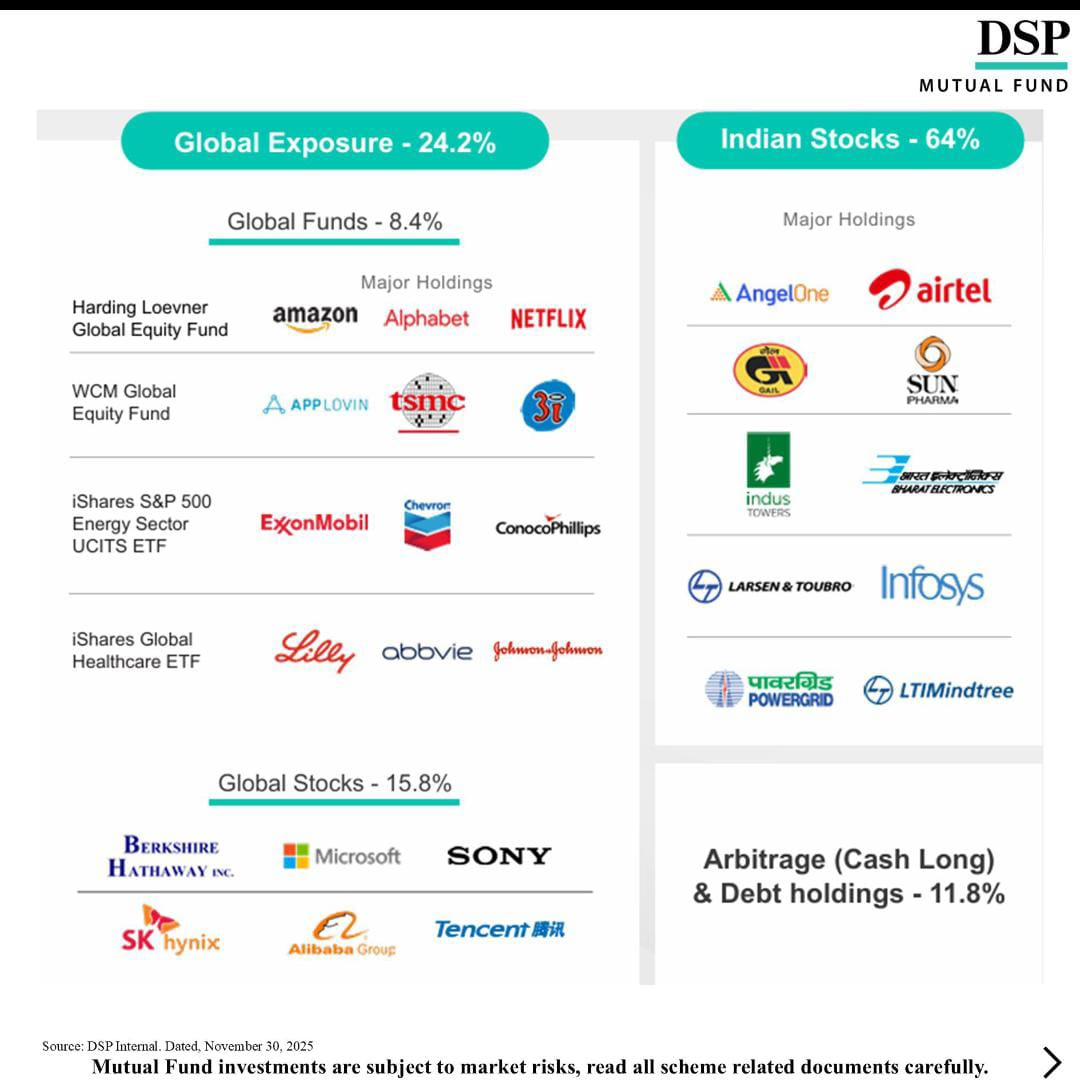

DSP value fund has a unique investment style. This fund invests 25% in Global stocks and 75% in Indian equities. It’s a good design and complimentary. Strategy to all equity funds in India because it has Zero exposure to lenders (vs 25% in index and funds) and this 25% is deployed globally into good companies at good price.

There is more excitement about newer funds and strategies (Including global fund at gift city).

As human beings, we prefer crossing easy ideas and designs. The portfolio is actually a flexi cap India and the world.

Case study of Global portfolio company DSP value fund,

SK Hynix – (Global Chip Company )

There is more excitement about newer funds and strategies (Including global fund at gift city).

As human beings, we prefer crossing easy ideas and designs. The portfolio is actually a flexi cap India and the world.

Case study of Global portfolio company DSP value fund,

SK Hynix – (Global Chip Company )

Memory chips demand exploding globally.

Samsung and SK Hynix signed agreements to supply chips and gear for open AI’s star gate supercomputer project, with demand projected at ~ 9, 00,000 wafers /months, more than double current global HBM capacity. Stocks still trade at 5-6x fund pe.DSP value funds hold position in this stock.

Best way to invest in fund - SIP

Samsung and SK Hynix signed agreements to supply chips and gear for open AI’s star gate supercomputer project, with demand projected at ~ 9, 00,000 wafers /months, more than double current global HBM capacity. Stocks still trade at 5-6x fund pe.DSP value funds hold position in this stock.

Best way to invest in fund - SIP